Former Zappos CEO’s Death Is the Latest Example of the Great Estate Planning Blind Spot

Successful, wealthy, famous, and influential people often seem to have it all. Their talents, intelligence, and vision take them to great heights. These folks have enormous wealth and complex portfolios of assets, as well as family members, employees, and others who depend on them for their livelihoods and well-being. They also have experienced lawyers and financial advisors of all stripes at their disposal.

Successful, wealthy, famous, and influential people often seem to have it all. Their talents, intelligence, and vision take them to great heights. These folks have enormous wealth and complex portfolios of assets, as well as family members, employees, and others who depend on them for their livelihoods and well-being. They also have experienced lawyers and financial advisors of all stripes at their disposal.

And yet, repeatedly, wealthy and powerful individuals who have achieved so much in life leave behind chaos in death because they didn’t have even the most basic elements of an estate plan.

A Long List of People Who Have Everything – Except an Estate Plan

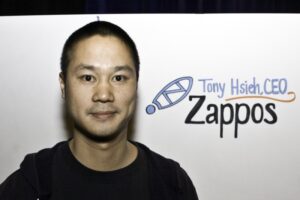

Former Zappos CEO Tony Hsieh, who died in November at the age of 46, is just the latest example of the estate planning blind spot from which so many people – famous or otherwise – suffer. Worth an estimated $840 million after building one of the world’s most lucrative internet commerce companies, Hsieh had not prepared a will or other estate planning documents before he passed away.

Hsieh joins a long list of successful and relatively young business people and celebrities who died suddenly and unexpectedly without a will – James Dean, Jimi Hendrix, Tupac, Kurt Cobain, and Amy Winehouse among them. Sadly, actor Chadwick Boseman, who passed away earlier this year, is also on the list, along with plenty of older, well-established people who lived decades in the limelight without ever addressing their estate planning blind spots:

- Prince

- Aretha Franklin

- Pablo Picasso

- Howard Hughes

- Sonny Bono

- Bob Marley

When hundreds of millions of dollars, the fate of global companies, or lucrative artistic legacies are involved, this lack of planning can lead to messy, expensive, and very public disputes. The confusion and uncertainty that these deaths can pit family members against each other, cost tens of millions of dollars, and take years to resolve.

But those disastrous consequences aren’t limited to people we read about in the newspaper. Even if you have a relatively modest estate, failing to have an estate plan in place can create a mess for your family and loved ones when you die. Not only will their grief be compounded by the stress and burdens of trying to sort through who gets what, but it can leave people for whom you would have otherwise provided out in the cold.

What Could Happen if You Don’t Have an Estate Plan

You don’t need to be a Prince or a Queen (of Soul) for the lack of an estate plan to leave your family in financial and emotional limbo when you pass away. If you die without a will, trust, or other estate planning documents:

- Your assets may not go to the people you would have selected. Instead, a judge you’ve never met will distribute your estate according to your state’s rules of intestate succession.

- Your estate will need to go through probate, a lengthy, costly, and public court proceeding.

- Your children and family members, lacking direction from you or having differing beliefs about your intentions, can become embroiled in conflicts about their rights and interests in your assets. Fierce court battles between siblings and others can irreparably poison the relationships that matter to you most.

- Your assets and any inheritance you leave behind can be significantly reduced by taxes and other liabilities that could have otherwise been avoided.

- If you become incapacitated and are unable to make decisions about your health or property, family members may differ about what to do and who should be in charge of those choices in the absence of your guidance.

Contact Kreis Enderle Today to Start Planning for Tomorrow

Rich and famous folks may not be like the rest of us in many respects, but the fact that so many pass away without an estate plan shows we all share one thing in common: we don’t like to think about our own demise. This is especially true when we’re younger and presumably have decades ahead of us, like Hsieh no doubt believed.

But given the pain, confusion, and other negative consequences that follow if you die without an estate plan, planning now can provide you and your family with peace of mind, security, and the satisfaction that comes from knowing you’ve taken care of those you love.

To start working on your comprehensive estate plan, please contact one of Kreis Enderle’s estate planning attorneys today.

Photo Credit: Charlie Llewellin from Austin, USA, via Wikipedia Commons